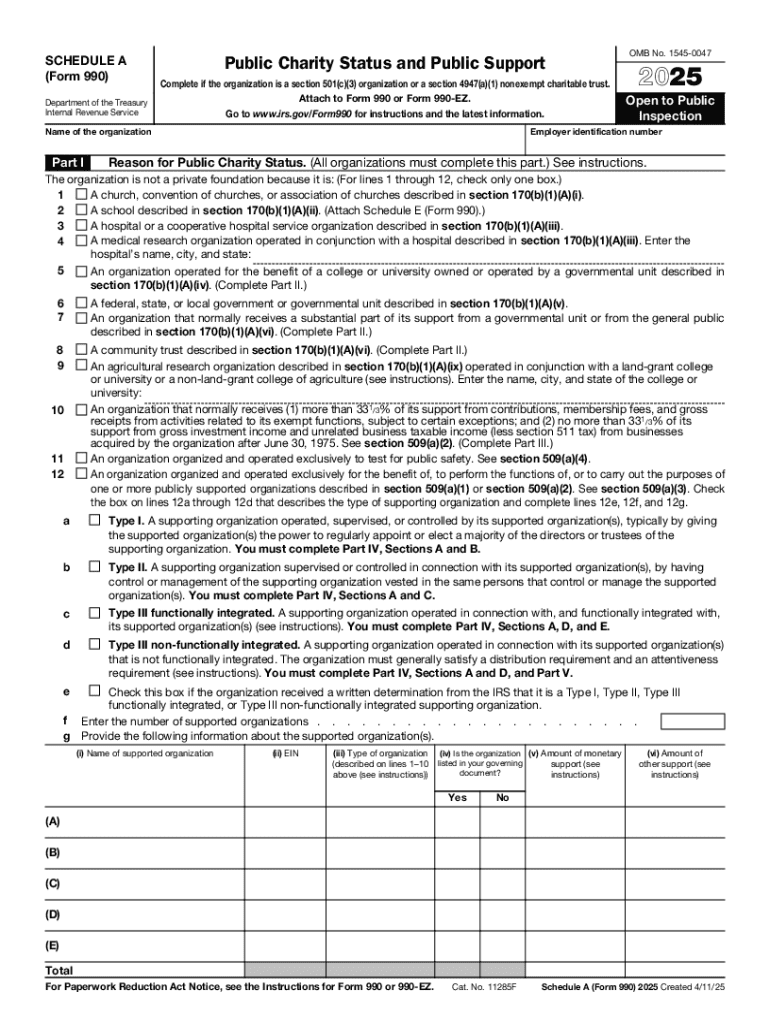

IRS 990 - Schedule A 2025-2026 free printable template

Instructions and Help about IRS 990 - Schedule A

How to edit IRS 990 - Schedule A

How to fill out IRS 990 - Schedule A

Latest updates to IRS 990 - Schedule A

All You Need to Know About IRS 990 - Schedule A

What is IRS 990 - Schedule A?

When am I exempt from filling out this form?

Due date

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 990 - Schedule A

What should I do if I find an error after submitting my IRS 990 - Schedule A?

If you discover an error after submission, you can file an amended IRS 990 - Schedule A to correct any mistakes. Ensure you clearly indicate that it is an amendment and follow the guidelines for making adjustments. This process helps maintain accurate records and compliance with IRS requirements.

How can I track the status of my IRS 990 - Schedule A after submission?

To verify the status of your IRS 990 - Schedule A, you can use the IRS online tracking tools or contact the IRS directly. Keep your submission confirmation handy, as it may help in referencing your specific filing when inquiring about its processing status.

What are common errors when filing IRS 990 - Schedule A that I should avoid?

Common errors when filing the IRS 990 - Schedule A include misreporting revenue amounts, incorrect categorization of expenses, and failing to provide complete information about board members. Review all entries carefully and ensure consistency with your supporting documentation to minimize mistakes.

Are there any specific requirements for e-signatures on IRS 990 - Schedule A?

Yes, e-signatures are acceptable for the IRS 990 - Schedule A as long as the e-filing software used complies with IRS guidelines. Ensure that you maintain records of authorization for e-signatures to meet legal and security standards during the filing process.

What steps should I take if my IRS 990 - Schedule A is rejected?

If your IRS 990 - Schedule A is rejected, first read the rejection notice to understand the reason. Common causes include incorrect formats or missing information. Rectify the issues identified and resubmit the form promptly to ensure compliance with IRS deadlines.

See what our users say